Calculating income tax in India, especially for salaried individuals, can be intricate. However, understanding this process is vital for effective personal finance management. It involves deciphering taxable salary, applicable tax rates, and factoring in exemptions and deductions. This knowledge empowers individuals to plan their finances efficiently and ensures compliance with tax laws.

This guide provides a step-by-step explanation of how to calculate income tax on salary.

Understanding Income Tax on Salary

As per the Income Tax Act of 1961, every salaried person in India is obligated to contribute a portion of their salary as income tax. This amount is referred to as income tax. The law encompasses various provisions and subsections (80C to 80U) detailing the intricacies of tax payments, deductions, and computations. Post factoring in all available tax-saving provisions and deductions, the final amount is remitted to the government as income tax on salary.

The Calculation Process

- Gross Salary: Sum up components like basic salary, allowances, bonuses, and taxable elements.

- Identify Exemptions: Recognize components like House Rent Allowance (HRA), Leave Travel Allowance (LTA), and Standard Deduction. Deduct these from your gross salary to determine taxable salary.

- Calculate Deductions: Leverage deductions under various sections of the Income Tax Act, such as Section 80C, 80D, and 24b. Subtract these from your taxable salary to arrive at your net taxable income.

- Determine Taxable Income: After considering exemptions and deductions, your taxable income is established.

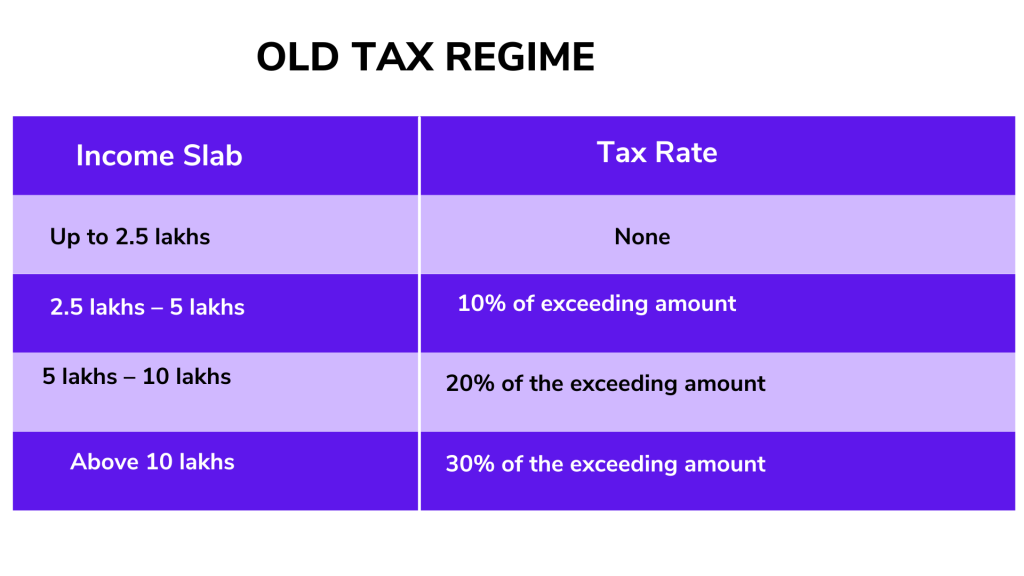

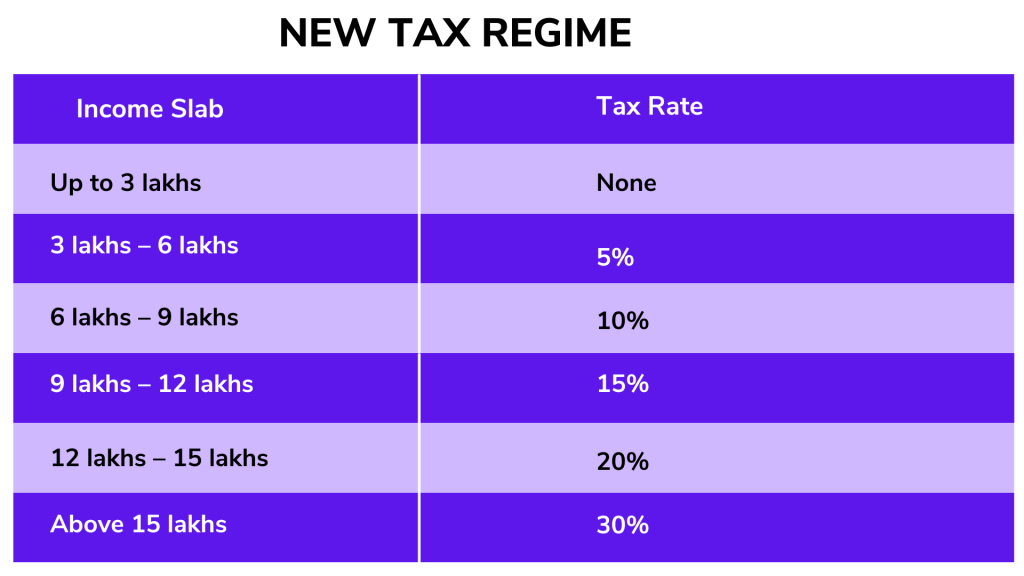

- Apply Income Slabs and Tax Rates: India employs a progressive tax system with different income slabs and corresponding tax rates. Calculate tax for each slab based on your taxable income.

- Calculate Tax Liability: Determine tax liability for each slab and aggregate them to ascertain your total income tax liability.

- Consider Rebates and Surcharge: Factor in any applicable rebates or surcharges based on your circumstances, such as the rebate under Section 87A for individuals with a taxable income up to Rs. 7 lakh.

- Calculate Health and Education Cess: Add the Health and Education Cess (currently 4%) to your total tax liability.

- Final Tax Liability: After considering all factors, your final income tax liability for the financial year is established.

- TDS and Advance Tax: For salaried individuals, the employer deducts Tax Deducted at Source (TDS) monthly, adjusting it against your final tax liability. If your tax liability exceeds Rs. 10,000 for the financial year, you may need to pay Advance Tax in installments.

- File Income Tax Return: Ensure compliance by filing your Income Tax Return (ITR) with the Income Tax Department, reporting your income, deductions, and tax payments.

Calculation of the income tax is very easy. The formula is for the old tax regime:

Basic salary

+ HRA

+ Special Allowance

+ Transport Allowance

+ any other allowance

————————————–

Gross income from salary

(-) Exemptions and Deductions

————————————–

Net taxable income

(Tax calculated according to the income tax slab)

Understanding Salary Components for Calculation

Key terminologies for calculating income tax:

- Tax Year: The previous financial year for which income tax is calculated, running from April 1 to March 31 of the next year.

- Assessment Year: Starting after the previous financial year, the year in which income tax is calculated for the previous financial year.

- Salary Breakup: Obtain details from the salary slip or statement, including exemptions like HRA, LTA, etc.

- Taxable Income: Calculate the income on which you need to pay tax, excluding exemptions.

- Deductions: Utilize deductions under Section 80 for investments, savings, and health insurance premiums.

- TDS: Tax Deducted at Source, deducted directly from your salary. Refundable if excess.

Calculating Tax Payable

- Calculate Tax Payable: Deduct applicable deductions and TDS to arrive at the tax amount payable to the Indian government.

- Income Threshold: No income tax if total income is less than 2.5 lakhs under the old regime. The new regime, defaulting from Budget 2023-24, offers a rebate up to 3 lakhs.

Strategies for Income Tax Saving

To minimize taxes, comprehending the salary structure is crucial:

- Taxable Salary Income: Salary minus exemptions (allowances, standard deduction, professional tax).

- Net Taxable Income: Subtract deductions under Chapter VIA from Taxable Salary Income.

Exploring Tax-Saving Instruments

Explore popular tax-saving instruments:

- ELSS (Equity Linked Savings Schemes): Equity mutual funds qualifying under Section 80C with a 3-year lock-in period.

- PPF (Public Provident Fund): Government-backed investment with a fixed interest rate and a 15-year lock-in period.

- ULIP (Unit Linked Insurance Plan): A hybrid of insurance and market-linked investments with a 5 to 20-year lock-in period.

- Deductions under Section 80: Various deductions available to reduce taxable income.

By leveraging these methods, individuals can enhance income and minimize tax liability, fostering financial growth and security.